1 Growth Stock Down 87% to Buy Right Now

Roku, the media-streaming technology innovator, has been on a roller coaster ride on Wall Street. Despite trading 36% below its annual peak and 87% down from its all-time highs in the summer of 2021, Roku’s growth story is still unfolding. The company made strategic decisions to prioritize market reach and sales growth over short-term profits, resulting in a low valuation that presents a compelling buying opportunity in April 2025.

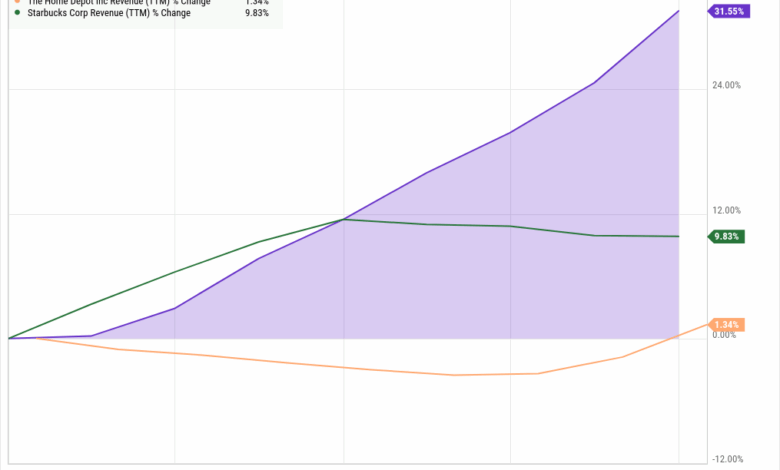

Currently trading at 2.2 times trailing sales, Roku’s valuation is comparable to mature, slow-growing businesses like The Home Depot and Starbucks. However, Roku is focused on maximizing revenue growth and expanding its global market presence. The company’s robust sales growth trajectory, fueled by increased R&D and marketing investments, sets it apart from its peers.

While Roku faces challenges in the competitive digital advertising space, its strong performance in the American market provides a solid foundation for international expansion. Similar to Netflix’s growth trajectory in the past, Roku has the potential to capitalize on global opportunities and deliver significant returns for investors.

Investing in Roku as a long-term growth opportunity requires a strategic approach to navigate market volatility. Consider spreading out investments over time or implementing a dollar-cost averaging plan to mitigate risks. Keep a close eye on Roku’s price-to-sales ratio and compare it to peers like Netflix to gauge its valuation in the market.

In conclusion, Roku presents a promising investment opportunity for growth-oriented investors. With its innovative technology and expanding market reach, Roku is positioned for success in the evolving media-streaming landscape. By carefully evaluating the company’s growth potential and market dynamics, investors can make informed decisions to capitalize on Roku’s long-term prospects.

This rewritten content seamlessly integrates the key points from the original article and provides a fresh perspective on Roku’s investment potential.