3 Artificial Intelligence (AI) Stocks That Can Weather President Trump’s Tariff Storm

The looming threat of tariffs has put many companies in a precarious position as imported goods become more expensive. This has the potential to deter consumers and businesses from making purchases, leading to a drop in spending and consumer confidence. The recent sell-off in the stock market is a direct result of investor concerns over the impact of tariffs on businesses.

Despite these challenges, there are three companies that are well-positioned to weather the storm caused by President Trump’s tariff policies. NVIDIA, Taiwan Semiconductor Manufacturing (TSMC), and Broadcom are all crucial suppliers for AI hardware, making them less susceptible to the negative effects of tariffs.

NVIDIA, known for its graphics processing units (GPUs), is a key player in the AI industry. Its GPUs are essential for training and operating AI models, giving the company a competitive edge in the market. Similarly, Broadcom produces connectivity switches and custom AI accelerators, which are expected to drive significant growth in the coming years.

TSMC plays a vital role in supplying chips to companies like NVIDIA and Broadcom. Despite initial concerns about tariffs, TSMC’s recent $100 billion investment in U.S. semiconductor production facilities has alleviated fears of price hikes for its products.

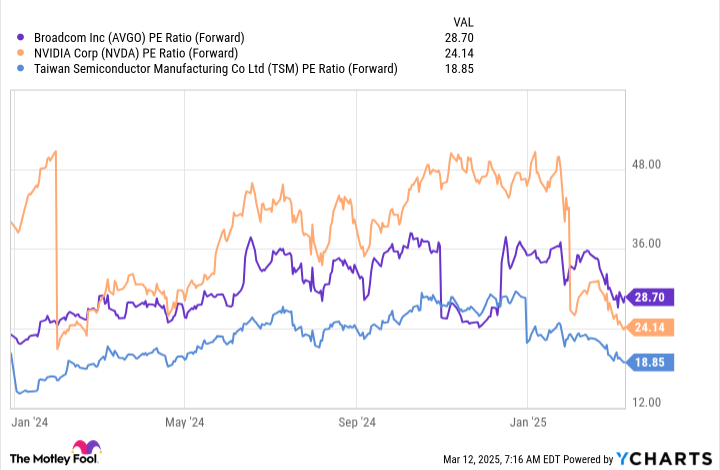

Investors have an opportunity to capitalize on the recent sell-off by purchasing shares of these companies at discounted prices. Taiwan Semiconductor, NVIDIA, and Broadcom all present attractive investment opportunities, especially considering their long-term growth potential in the AI industry.

In conclusion, while the threat of tariffs remains a concern for many companies, NVIDIA, TSMC, and Broadcom are well-positioned to navigate these challenges. By focusing on the long-term prospects of these companies, investors can make informed decisions that align with their investment goals.