Donald J. Trump’s return to the White House is expected to bring significant shifts in U.S. economic policy, with repercussions across global markets. Known for his “America First” stance, Trump’s policy agenda could redefine trade, energy, and defense priorities. Here are four key policies that could shape the global economy in the coming years.

1. Renewed Trade Tensions and Tariffs

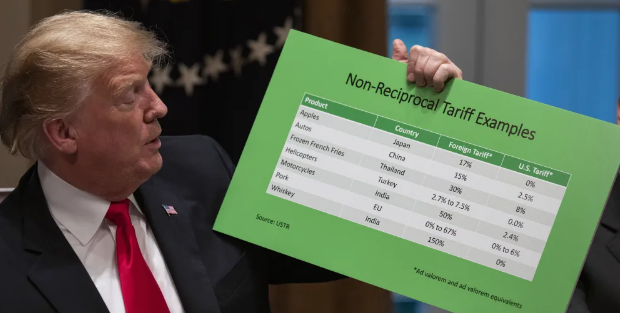

Trump’s past term was marked by an aggressive approach to trade, particularly with China, and experts anticipate a similar stance this time around. Trump is likely to reintroduce or increase tariffs on imported goods, especially from China, as part of his goal to strengthen U.S. manufacturing. Such tariffs could disrupt global supply chains, potentially increasing prices for consumers worldwide. This “decoupling” could also push companies to diversify their sourcing, possibly benefiting other manufacturing hubs in Asia.

2. Energy Independence and Oil Production Boosts

Trump’s administration previously prioritized domestic energy production, reducing reliance on foreign oil imports. A renewed focus on fossil fuel independence could lead to deregulation in the energy sector, increasing U.S. oil and gas production. This boost could lower global oil prices, affecting economies that are heavily reliant on oil exports, particularly in the Middle East and Russia. Additionally, Trump’s return to pro-fossil fuel policies could challenge global efforts to combat climate change, as he may pull back on green energy initiatives in favor of traditional energy sectors.

3. Defense Spending and NATO Relations

Trump’s approach to foreign alliances, especially NATO, often involved pressuring member countries to increase their own defense spending. This time, he could take an even firmer stance, potentially reducing U.S. contributions to NATO or scaling back military support in regions like Europe and Asia. Such a shift would likely prompt NATO members and allied nations to bolster their defense budgets, which could have implications for global defense markets and increase regional tensions, particularly in Eastern Europe and the South China Sea.

4. Tighter Immigration Policies Impacting Labor Markets

Trump has consistently advocated for stricter immigration controls, which could lead to changes in the availability of immigrant labor in sectors like agriculture, construction, and technology. A reduction in the immigrant workforce may strain labor markets in the U.S., possibly driving up wages and costs in key industries. This shift could also impact remittances sent by immigrant workers back to their home countries, potentially affecting economies dependent on these funds, particularly in Latin America and parts of Asia.

Conclusion

With these policies likely to take center stage, Trump’s presidency could have lasting effects on the global economy. His focus on American economic interests will reverberate worldwide, reshaping international trade, energy dynamics, defense spending, and labor markets for years to come.