4 Pipeline Stocks to Buy With $1,000 and Hold Forever

Pipeline companies continue to thrive despite the current disruptions in the energy markets. These companies operate as toll-road businesses, meaning that energy prices have a moderate direct impact on their results. Additionally, the demand for natural gas is on the rise, driven by increased power consumption due to artificial intelligence (AI), export demand to Mexico, and the need for liquefied natural gas (LNG) in Asia and Europe.

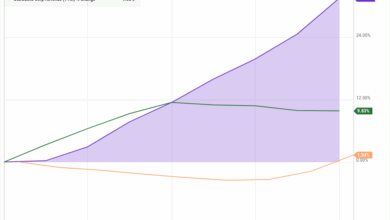

Investors looking for long-term growth opportunities in the energy sector can consider investing in pipeline stocks. Four notable pipeline companies worth considering include Energy Transfer (NYSE: ET), Enterprise Products Partners (NYSE: EPD), The Williams Companies (NYSE: WMB), and Kinder Morgan (NYSE: KMI).

Energy Transfer operates a vast integrated midstream system, particularly well-positioned in the Permian Basin, a prolific oil basin in the U.S. The company has significant growth project opportunities, such as the Hugh Brinson Pipeline, aimed at meeting the growing power demand in Texas driven by AI. With a robust project backlog and an attractive 7.9% yield, Energy Transfer is set for solid growth in the coming years.

Enterprise Products Partners, known for its consistency in increasing distributions, is also focused on growth projects, with plans to spend between $4 billion and $4.5 billion in the current year. With $7.6 billion in growth projects under construction, Enterprise is poised for growth in the near future.

The Williams Companies owns the valuable Transco natural gas pipeline system, which spans from Appalachia to the Gulf Coast, providing numerous expansion opportunities. With a focus on growth and plans to increase its dividend by more than 5% this year, Williams offers a 3.5% yield to investors.

Kinder Morgan plays a vital role in the U.S. midstream sector, with a strong presence in the Permian Basin and Texas. The company has seen an increase in growth-project opportunities, leading to a rise in its project backlog and improved balance sheet. With a 4.5% yield and solid growth prospects, Kinder Morgan is a promising investment option.

Before making investment decisions, it’s essential to conduct thorough research and consider all factors. While these pipeline companies show promise for long-term growth, investors should assess their individual financial goals and risk tolerance before investing. By staying informed and making informed decisions, investors can capitalize on the opportunities presented by the energy sector’s evolving landscape.