U.S. Retail Sales Rebound and Jobless Claims Fall in November 2023

November 2023 marked a surprising rebound in U.S. retail sales, signaling a more robust than anticipated consumer spending pattern during the holiday shopping season. This unexpected increase paints a positive picture of the U.S. economy’s resilience in the face of various economic challenges.

Key Highlights:

- Retail Sales Growth: Retail sales in the United States rose by 0.3% in November from October, beating expectations of a decline. This increase follows a revised 0.2% decrease in October. The rise in retail sales is primarily due to increased consumer spending as the holiday season kicked off. Notably, excluding automobiles and gasoline, sales experienced an even more substantial rise of 0.6%.

- Sector-Wise Performance: The increase in retail sales was not uniform across all sectors. While restaurants saw a 1.6% increase and furniture stores experienced a 0.9% rise, electronic and appliance sales witnessed a decline of 1.1%. Similarly, department store sales fell by 2.5%. However, clothing and accessories stores showed a 0.87% increase month-over-month.

- Online Sales Surge: A significant contributor to the retail sales growth was the online and non-store sector, which saw a 0.8% increase month-over-month and a notable 26.27% increase year-over-year.

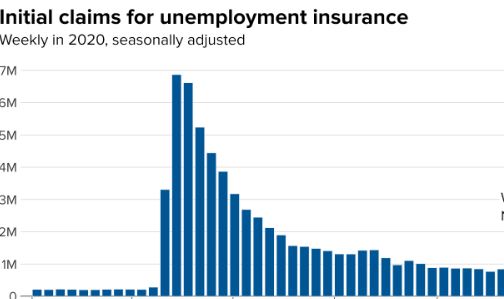

- Jobless Claims Drop: Complementing the positive news in retail, weekly jobless claims in the U.S. also fell unexpectedly. Initial claims for state unemployment benefits dropped to 202,000 for the week ended Dec. 9, a decrease of 19,000 from the previous week. This decline surpassed economists’ forecasts, which had predicted around 220,000 claims.

- Economic Implications: These figures suggest that consumer spending, a critical driver of the U.S. economy, remains strong despite challenges like higher borrowing costs and ongoing inflation concerns. The rebound in retail sales and the fall in jobless claims are optimistic indicators for the overall health of the economy.

Economic Outlook:

While the growth in retail sales and the drop in jobless claims are positive signs, the broader economic context remains mixed. Inflation, though cooling from its peak, continues to be a concern. However, the Federal Reserve’s recent signals of easing monetary policy in 2024 and the resilience in the labor market suggest that the U.S. economy may avoid a recession and continue on a path of moderate growth.

This combination of strong retail sales and declining jobless claims in November 2023 indicates that the U.S. economy is navigating through its challenges with a degree of resilience, bolstered by steady consumer spending and a robust job market.