Why Millions Of Americans Are Tapping Their 401(k) Savings Early

Millions of Americans are facing financial challenges that are prompting them to tap into their 401(k) savings early. This trend highlights the economic strain that many households are currently experiencing, despite positive employment figures. According to data from Vanguard Group, last year saw a record high of 4.8% of 401(k) account holders taking early withdrawals for reasons such as medical bills or mortgage payments. This marked a significant increase from the previous year and more than doubled the pre-COVID withdrawal rate.

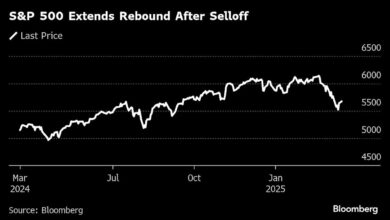

The contradictory economic conditions in the country are contributing to this trend. While unemployment remains low and wages are on the rise, inflation in essential categories like groceries is putting a strain on household budgets. Declining consumer sentiment and rising delinquencies in vehicle financing and credit card debt are also adding to the financial challenges faced by many Americans.

David Stinnett, head of strategic retirement consulting at Vanguard, emphasized the importance of having savings to turn to during times of financial hardship. Two key factors are driving the trend of early 401(k) withdrawals. The first is the increasing prevalence of workplace retirement plans with automatic enrollment practices. Vanguard’s data shows that 61% of retirement plans under its management now automatically sign up new employees, compared to just 36% a decade ago.

Secondly, regulatory changes have made it easier for individuals to access their retirement savings during difficult times. Legislation passed in 2018 eliminated the requirement to exhaust 401(k) loan options before requesting hardship distributions. Additionally, another law passed in 2022 allows for emergency withdrawals up to $1,000 annually without penalties, provided the funds are returned before subsequent withdrawals.

Despite the increase in early withdrawals, overall 401(k) balances rose by an average of 10% in 2024, reaching a record high of $148,153. The share of participants with outstanding 401(k) loans remained steady at 13%. As more employers automatically enroll workers and increase their contribution rates, retirement accounts are increasingly serving as emergency funds for Americans facing financial difficulties.

In conclusion, the trend of early 401(k) withdrawals reflects the challenging financial landscape that many Americans are navigating. While tapping into retirement savings early may provide temporary relief, it’s essential for individuals to consider the long-term implications and explore alternative financial solutions. By understanding the factors driving this trend and staying informed about financial options, individuals can make informed decisions to secure their financial future.