Wall Street bonuses hit record $47.5B in 2024

Wall Street Sees Record-High Bonus Pool in 2024

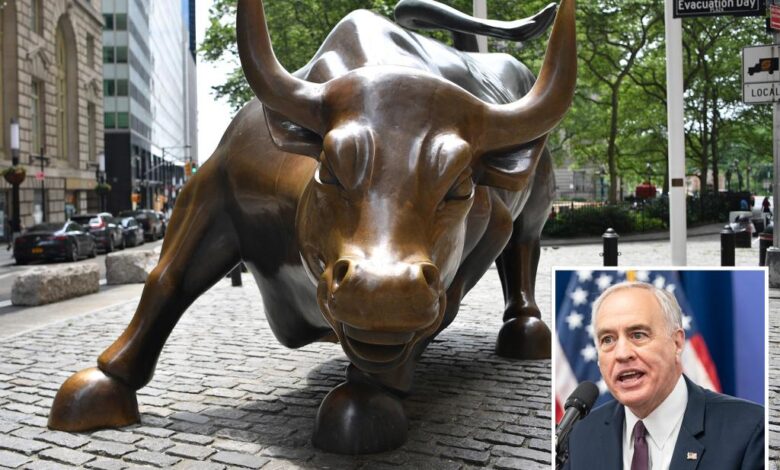

In a surprising turn of events, Wall Street’s bonus pool reached a record high last year, with bankers taking home an average of $244,700 each, marking a significant 31% increase from the previous year. The data, released by New York State Comptroller Thomas P DiNapoli, revealed that the total bonus pool amounted to an astonishing $47.5 billion, a 34% surge from the previous year and the highest figure recorded since 1987.

DiNapoli’s report focused on cash bonuses rather than deferred compensation like stock options. The increase in compensation was attributed to New York’s banks bouncing back from the impact of COVID-19 lockdowns. Profits in the finance industry in the city surged by 90% in 2024, driven by stronger trading, underwriting, and dealmaking revenues.

According to DiNapoli, the record-high bonus pool reflects the strong performance of Wall Street in 2024, which bodes well for New York’s economy. However, the comptroller also cautioned that economic uncertainty and federal policy changes could potentially reverse this trend in 2025.

The surge in profits also led to an increase in job numbers on Wall Street, reaching its highest level in nearly three decades. The finance industry in New York now employs 201,500 individuals, surpassing the previous peak seen in 2000. Wall Street accounts for 19% of the state’s tax collection and 7% of the city’s revenue, highlighting its significant contribution to the economy.

Additionally, financial services firms have played a crucial role in driving new leasing activity and property development in the city since the pandemic. For example, JPMorgan Chase’s decision to bring employees back to a new 60-story headquarters building in Midtown has further fueled economic growth in New York City.