T. Rowe Price likes stock picking now

T. Rowe Price is reaping the benefits of the booming growth in actively managed exchange-traded funds (ETFs). Tim Coyne, the head of ETFs at the firm, shared that T. Rowe Price is experiencing significant expansion in this area, citing the T. Rowe Price Capital Appreciation Equity ETF (TCAF) and T. Rowe Price U.S. Equity Research ETF (TSPA) as two established strategies meeting investor demand.

Coyne emphasized the value of professionally managed portfolios in the current market environment, characterized by heightened volatility and uncertainty across equity and fixed income markets. The T. Rowe Price Capital Appreciation Equity ETF is designed for investors seeking long-term growth, aiming to outperform the S&P 500 with lower volatility and greater tax efficiency. This ETF maintains a more concentrated portfolio, typically holding around a hundred names.

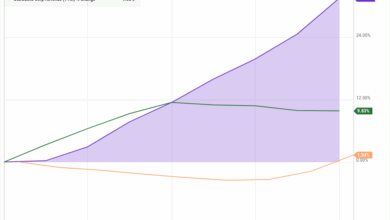

Top holdings in the T. Rowe Price Capital Appreciation Equity ETF as of April 24 include tech giants like Microsoft, Amazon, and Apple, along with positions in companies like Becton Dickinson and Roper Technologies. While the fund is down approximately 5% year-to-date, it has delivered a solid 8% return over the past year, aligning closely with the performance of the S&P 500.

On the other hand, the T. Rowe Price U.S. Equity Research ETF follows a similar strategy but with a heavier emphasis on top tech stocks. Managed by North American directors of research at T. Rowe Price, this ETF blends characteristics of passive and active investing, leveraging strong fundamental research for stock selection. Despite a 7% decline since the start of the year, the fund has surged nearly 9% over the past year, slightly outperforming the S&P 500.

Todd Sohn from Strategas Securities believes that the demand for active managers will remain robust, especially in the current market environment, which he views as a form of bear market. Sohn highlighted the potential for active managers to shine in such conditions by offering tailored solutions to navigate market challenges effectively.

In conclusion, T. Rowe Price’s success in the actively managed ETF space underscores the value of professionally managed portfolios in volatile markets. With a focus on long-term growth and strategic stock selection, T. Rowe Price’s ETF offerings continue to attract investor interest and deliver competitive returns.