$300M fund from Icebreaker Finance targets Bitcoin miners

- Icebreaker Finance will offer fully collateralised loans to blue-chip mining companies.

- Loan periods are of 12-18 months and interest rates of 15-20%.

- The fund is open to miners in North America, Canada and Australia, the company announced on Tuesday.

Icebreaker Finance, an Australian-founded firm that’s seeking to leverage blockchain technology to improve capital markets, has unveiled a $300 million fund on DeFi platform Maple to help finance bitcoin miners.

The fund will target secured debt financing towards the leading bitcoin mining companies – both public and private – across North America, Canada and Australia, the firm said.

Icebreaker’s move comes at a time many BTC mining firms have struggled amid the crypto winter and rising electricity costs, with some opting to sell their mined coins to meet cash obligations.

“Recent market headwinds have caused lenders to pull back, while traditional financing vehicles have been slower to engage this sector. Miners play an essential role in growing the crypto ecosystem and local economies, and we are proud to extend a new financing vehicle to direct capital where it is needed the most,” said Sidney Powell, CEO and Co-Founder of Maple Finance.

Collateralised loans to blue-chip miners

As Icebreaker Finance notes in its announcement, miners can now access 12-18 month loans at interest rates of about 15-20% to boost their operations.

Offered to blue-chip Bitcoin miners, the loans will be handled on a first-priority basis, with Icebreaker evaluating each need based on a miner’s balance sheet strength, treasury, financial performance, and operational efficiency among other factors.

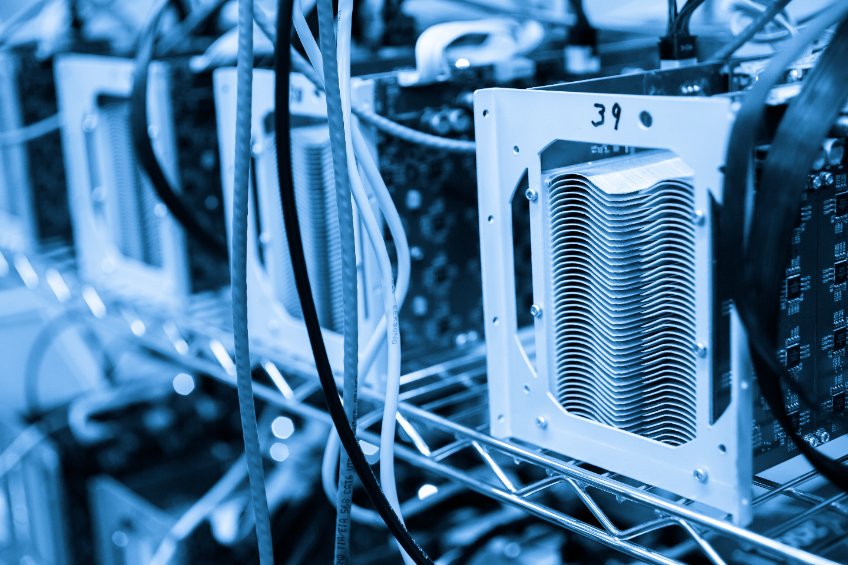

Collateral will be both by real-world assets and digital assets, with the former requirement involving mining rigs and power transformers among other infrastructure assets.

Recourse will be on the borrower, Icebreaker noted in its blog post, with company’s founder and CEO Glyn Jones commenting on this by noting:

“The market is now maturing to appreciate that non-recourse SPV ASIC backed financing can be inappropriate given the volatility in value of ASICs. Instead, a more diverse security package is required. Maple’s out-of-the-box, on-chain lending toolkit enables us to align incentives of lenders and borrowers to execute loans on-chain with terms that reflect the emerging nature of the industry more efficiently than we could elsewhere.”

Source link