Other

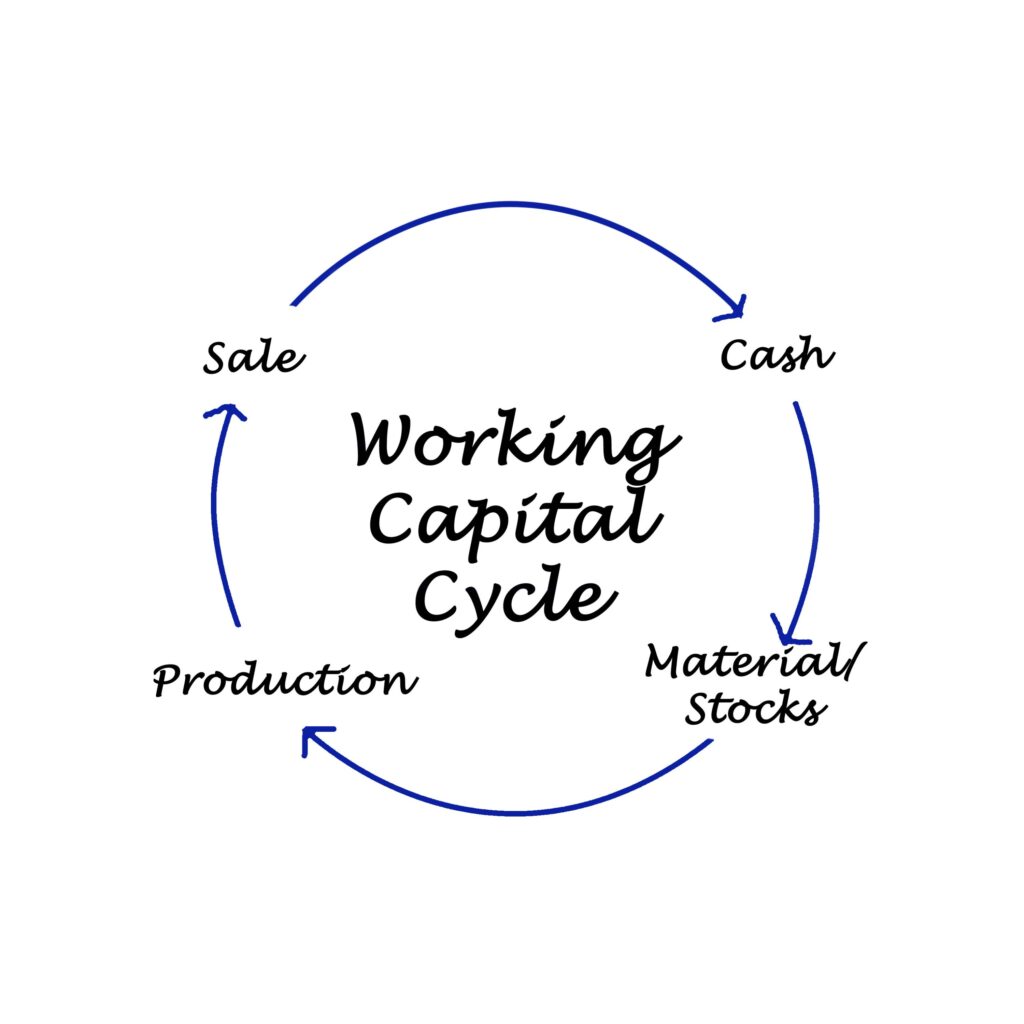

Accessing working capital for your business

Accessing working capital is essential for businesses to maintain their day-to-day operations, invest in growth opportunities, and handle unexpected expenses. Here are five ways businesses can secure working capital:

- Business Line of Credit:

A business line of credit is a flexible and revolving financing option that allows businesses to access funds up to a predetermined credit limit. Similar to a credit card, businesses can draw funds as needed and only pay interest on the amount borrowed. This option provides quick access to working capital for short-term needs and is suitable for managing fluctuations in cash flow. - Small Business Loans:

Traditional small business loans are a common source of working capital. Banks, credit unions, and online lenders offer various loan products tailored to businesses’ needs. Term loans provide a lump sum of money that is repaid over a specified period with interest. Businesses can use small business loans for various purposes, such as purchasing inventory, expanding operations, or investing in equipment. - Invoice Financing or Factoring:

For businesses with outstanding invoices from customers, invoice financing or factoring can provide immediate working capital. In invoice financing, a lender advances a percentage of the unpaid invoice value, allowing businesses to access cash before the customers pay. In contrast, factoring involves selling the invoices to a third-party (factor) at a discounted rate, transferring the responsibility of collecting payment to the factor. - Merchant Cash Advance:

Merchant cash advance (MCA) is a financing option where businesses receive a lump sum payment in exchange for a portion of their future credit card sales or daily revenue. Repayments are made through a fixed percentage of daily credit card sales or bank deposits. MCAs are accessible quickly and are suited for businesses with a high volume of credit card transactions. - Crowdfunding and Peer-to-Peer Lending:

In recent years, crowdfunding and peer-to-peer (P2P) lending platforms have gained popularity as alternative sources of working capital. Through crowdfunding, businesses can raise funds from a large pool of individual investors who contribute small amounts. P2P lending involves borrowing directly from individuals through online platforms, bypassing traditional financial institutions. These methods can be useful for startups and small businesses that may not qualify for conventional loans.

Before choosing a specific method to access working capital, businesses should evaluate their financial needs, repayment capabilities, and the terms and conditions of the financing options available. Consulting with financial advisors or experts can help businesses make informed decisions and secure the most suitable working capital solution for their specific circumstances.