Bets on US Weakness Are Fueling a Rally Across Emerging Markets

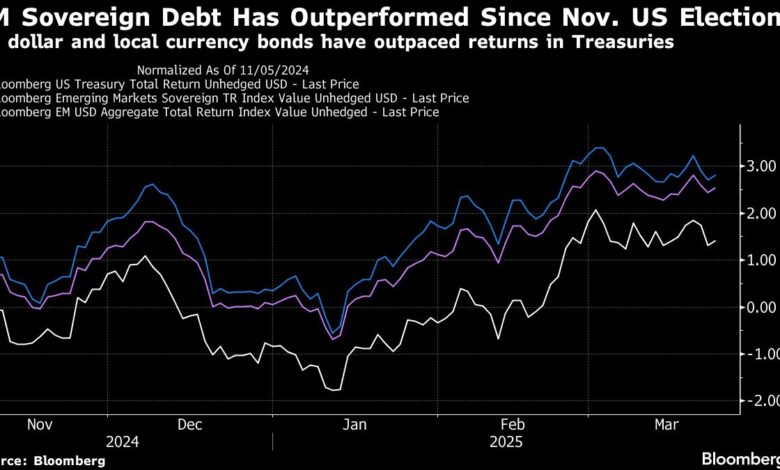

The allure of emerging markets is on the rise as investors look beyond the US economy for opportunities. With concerns over President Donald Trump’s tariff policies potentially impacting US growth, portfolio managers are turning their attention to assets in Latin America and Eastern Europe. This shift has already led to a surge in EM equities, with the best first quarter performance since 2019. A weaker dollar has also boosted developing currencies and local bonds.

Bob Michele, global head of fixed income at JPMorgan Asset Management, notes that emerging markets are currently undervalued compared to more developed markets. This presents an attractive opportunity for investors who have traditionally favored US assets. The rally in emerging markets, however, is contingent on the trajectory of US growth. A gradual cooling of the US economy due to tariffs could benefit EM assets, as long as it doesn’t lead to a broader market slowdown.

Despite past false dawns for emerging markets, investors remain optimistic about the potential for growth in the asset class. Many countries offer inexpensive assets relative to the S&P 500, and with net asset inflows into dedicated funds yet to turn positive in 2025, there is room for further upside. The end of US exceptionalism trade is seen as a long-term trend by analysts at Ashmore Group, signaling a potential decade-long shift in asset allocation.

Edwin Gutierrez, head of EM sovereign debt at Aberdeen Group plc, highlights the opportunities in emerging European countries. BlackRock Inc. strategists Axel Christensen and portfolio manager Laurent Develay point to bright spots in Latin America, suggesting that any temporary weakness due to trade uncertainty could be a buying opportunity for local EM bonds. Funds like TCW Group and T. Rowe Price have been investing in sovereign notes from Colombia and South Africa, while Franklin Templeton’s new low volatility global bond fund has focused on hard currency debt from Indonesia, Philippines, and South Korea.

Overall, the unwind of US exceptionalism and a weaker dollar are seen as positive drivers for EM assets. Emerging currencies have been strengthening against the dollar, with countries like Brazil, Chile, and Colombia experiencing gains. While there are risks that could derail these trades, such as a resilient US economy or less severe tariffs than expected, many investors remain bullish on the outlook for emerging markets. With cautious optimism, fund managers like Eric Souders of Payden & Rygel are cautiously optimistic about the potential for growth in EM assets.

As the global economic landscape continues to evolve, emerging markets present an attractive opportunity for investors seeking diversification and potential returns. By carefully navigating the risks and opportunities in these markets, investors can capitalize on the shifting trends in the investment landscape.