Bloomberg Analyst Predicts Massive but Historically ‘Normal’ Market Crashes for Bitcoin, Oil and Stock Market

Bloomberg Strategist Warns of Potential Market Correction

Bloomberg commodity strategist Mike McGlone is sounding the alarm on a possible massive correction in US markets that could have far-reaching effects on assets like Bitcoin, oil, and stocks.

McGlone took to social media platform X to share his concerns about the current state of the US economy and the potential for a market downturn. He points to a “self-correcting mechanism” that could push back against President Trump’s tariff policies, leading to market chaos.

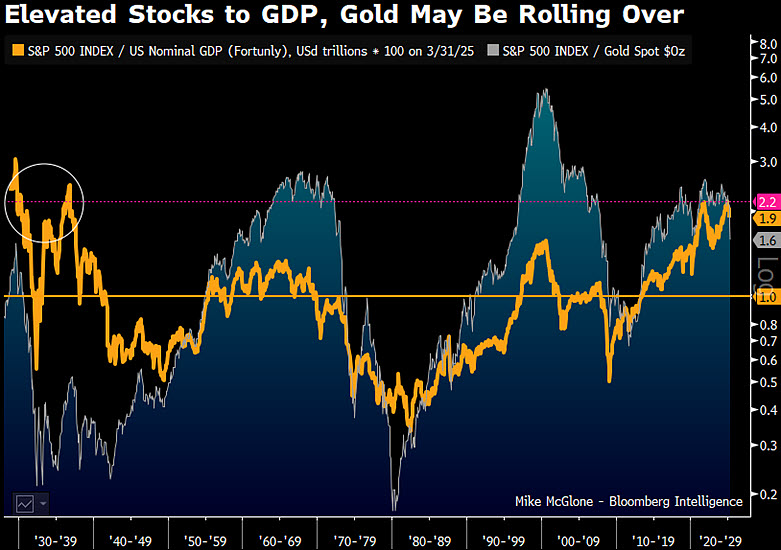

One of the key indicators McGlone highlights is the elevated levels of the S&P 500 vs. GDP ratio and the S&P 500 vs. gold ratio. Historically, these ratios have preceded stock market crashes, such as those seen in the 1930s, late 1990s, and 2008.

According to McGlone, a market reversion event could result in significant drops in stocks, Bitcoin, oil, copper, and bonds. He outlines a base case scenario that includes a 50% drawdown in the US stock market, $40 a barrel crude oil, $3 per pound copper, 3% US 10-year yield, $10,000 Bitcoin, and $4,000 gold.

Despite the severity of his predicted drawdowns, McGlone believes that the potential downside moves are “normal” in historical terms. As of the time of writing, Bitcoin is trading at $87,529.

For more updates, follow us on X, Facebook, and Telegram.

Stay informed with email alerts and check out the latest price action on The Daily Hodl Mix.

Image generated by Midjourney.