China knows Trump’s breaking point

President Trump’s trade war has been a rollercoaster ride, with weeks of frantic tariff activity causing chaos in financial markets. While Trump aims to overhaul America’s trade system, it’s clear that his primary target is China. By imposing tariffs on imports from nearly every country and increasing tariffs on Chinese imports to a staggering 145%, Trump has escalated tensions with the world’s second-largest economy.

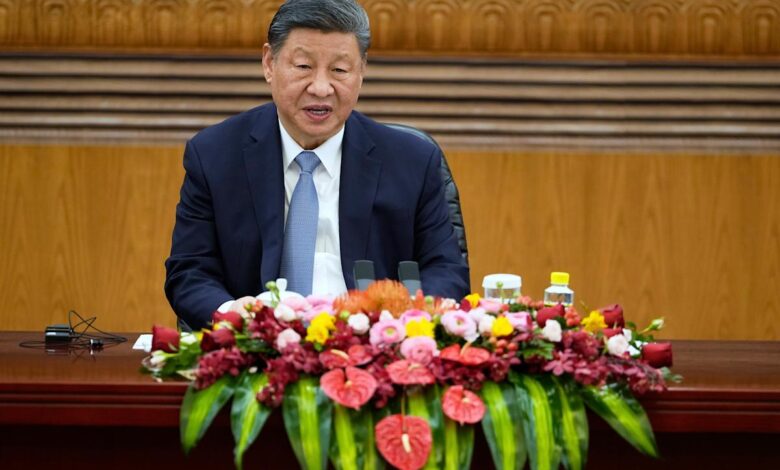

China has retaliated fiercely, raising tariffs on American goods to 125% and taking other punitive measures. President Xi Jinping, a proud leader with a vision of Chinese economic supremacy, is unlikely to back down easily. The trade war between the US and China has far-reaching consequences, affecting not only the two countries but also global markets.

The impact of Trump’s tariffs on American businesses and consumers is evident in the stock market, where prices have plummeted. The threat of a credit crisis looms large, as bond yields have risen unexpectedly, and the value of the dollar has fallen. China’s ownership of US Treasury securities adds a layer of complexity to the situation, with the potential for economic turmoil on both sides.

As an autocrat, Xi may have more staying power than Trump, but China is not immune to the effects of prolonged trade tensions. The ongoing battle between the two economic giants is a high-stakes game with no clear winner in sight. Trump’s willingness to negotiate is overshadowed by his interest in decoupling the US and Chinese economies, a move that could have irreversible consequences.

By zeroing in on China, Trump may be concentrating his resources on a formidable adversary, potentially overlooking other trade partners. While China may not emerge victorious in a trade war, it has the capacity to inflict significant damage. The future of US-China relations hangs in the balance, with far-reaching implications for the global economy.

As the trade war rages on, investors and policymakers are left to navigate the uncertain terrain of international trade. The ramifications of Trump’s tariffs and China’s retaliatory measures are felt far and wide, underscoring the interconnectedness of the global economy. Only time will tell how this high-stakes showdown between two economic powerhouses will unfold.

In conclusion, the trade war between the US and China is a complex and evolving saga with far-reaching implications. As both sides dig in their heels, the global economy hangs in the balance, with ripple effects that could be felt for years to come. Stay tuned for the latest developments in this high-stakes game of economic brinkmanship.