Chinese Bonds Recover From Selloff as PBOC Steps Up Cash Support

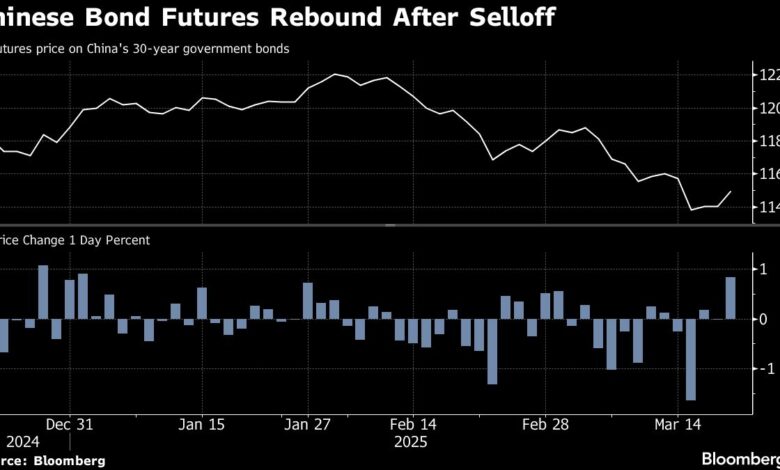

Chinese government bonds have shown signs of recovery as the country’s central bank, the People’s Bank of China (PBOC), provided short-term funding support. Yields on the benchmark 10-year note dropped by 3 basis points to 1.84%, marking the third consecutive day of declines. Additionally, futures on the 30-year paper surged by as much as 1%, the most significant increase since late December.

The recent gains in the Chinese bond market can be attributed to the PBOC’s injection of 973.2 billion yuan ($134.6 billion) via short-term policy loans over the past four days. This move comes after two weeks of draining and marks the longest streak of injections since late January. The supply of new cash indicates growing official concerns about the risks stemming from the recent bond rout caused by the PBOC’s efforts to defend the yuan and a rally in Chinese stocks.

With the global retreat of the US dollar, Beijing can now focus on reducing borrowing costs to achieve its ambitious annual economic growth target and help investors absorb a spike in debt issuance. Analysts, led by Liu Yu at Huaxi Securities, believe that the PBOC’s continued injections will prevent the debt selloff from worsening and restore confidence in the bond market. They suggest that the bond market has the potential to enter a moderately bullish phase with the support signal provided by the central bank.

Earlier this year, China’s money market faced pressure when the PBOC allowed a cash crunch to push key short-term funding costs to their highest levels since June. Despite this, the central bank refrained from lowering interest rates or banks’ required reserve ratio since September. Meanwhile, China’s annual supply of new government bonds is expected to rise to 11.86 trillion yuan this year, following an increase in the general budget deficit target to around 4% of GDP, the highest level in more than three decades.

Becky Liu, head of China macro strategy at Standard Chartered Bank in Hong Kong, believes that the PBOC should feel more at ease with the yuan as depreciation pressures have eased recently. This could lead to less need for tight liquidity measures in the future.

In conclusion, the Chinese bond market’s recovery is a positive sign for investors, supported by the PBOC’s efforts to stabilize the market. As the global economic landscape evolves, it will be interesting to see how China’s monetary policy adapts to ensure stability and growth in the bond market.

This article was originally published on Bloomberg and has been updated with additional comments and details. ©2025 Bloomberg L.P.