Corrections are unhealthy – Econlib

Reevaluating the Concept of Market Corrections

When discussing market corrections, two key issues come to light. Firstly, the term “correction” is often used asymmetrically, primarily in reference to price declines rather than increases. Secondly, market corrections are commonly perceived as a positive adjustment, akin to rectifying a mistake on an exam. However, it’s essential to recognize that most stock market declines stem from unfavorable circumstances.

While some may argue that market corrections are a healthy and necessary part of the market cycle, it’s crucial to delve deeper into the underlying reasons behind these fluctuations. Not all corrections indicate a positive shift in the market. In fact, events such as trade wars can have detrimental effects on stock prices and overall market stability.

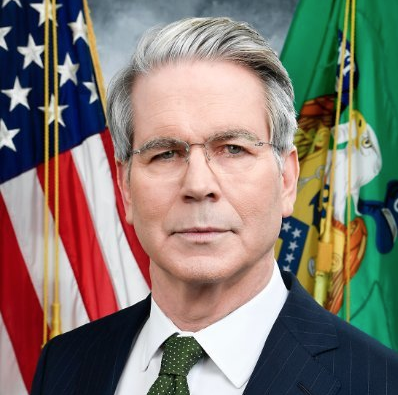

As Treasury Secretary Scott Bessent aptly put it, market corrections are a natural occurrence in the investment world. However, it’s essential to differentiate between corrections that result from sound economic policies and those driven by external factors that could harm the market in the long run.

Looking back at historical examples, such as the Smoot-Hawley tariff bill in 1930, we can see the lasting impact of ill-advised trade policies on the stock market. President Hoover’s decision to sign the bill led to a significant market decline, with repercussions that lasted for years to come.

It’s important to note that market predictions are inherently complex and influenced by a myriad of factors. While it’s tempting to rely on optimistic outlooks, it’s crucial to remain vigilant and consider all potential outcomes. As recent market trends indicate, overlooking the warning signs of a market downturn can have significant consequences.

Ultimately, the key takeaway is to approach market corrections with a critical lens and a thorough understanding of the underlying forces at play. By staying informed and proactive in our investment strategies, we can navigate market fluctuations with greater resilience and adaptability.

Update: Market Sentiment

Recent market developments align with the cautious approach advocated in this article. Despite initial reassurances from officials, such as Treasury Secretary Bessent, about the market’s resilience, recent downturns highlight the need for continued vigilance and strategic decision-making in the face of economic uncertainties.