Cryptocurrencies are a speculative asset

Cryptocurrencies are also not a “great store of value,” Powell said at Cato Institute in Washington.

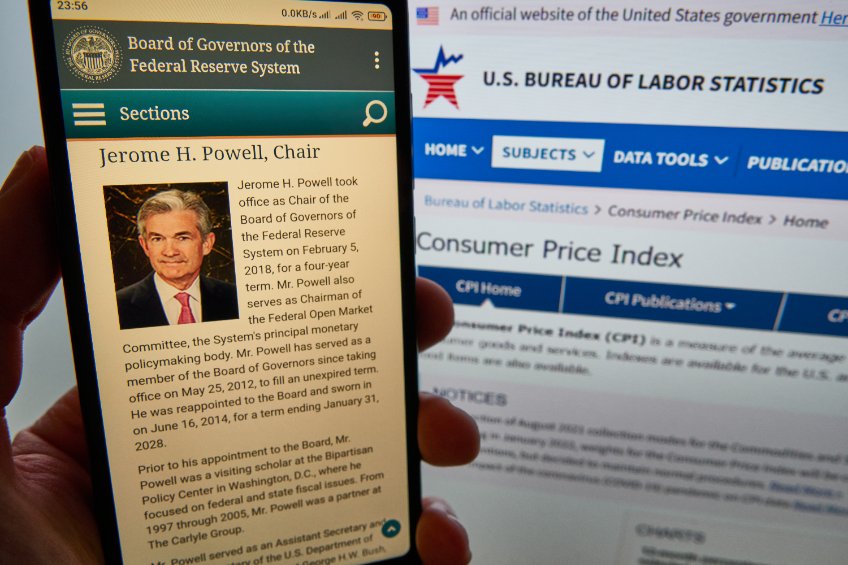

US Federal Reserve Chair Jerome Powell said on Thursday that cryptocurrencies are not being used for payments as such, noting that public interest in these assets lies more in their speculative nature.

Powell said this during a conference at the Cato Institute, Washington, D.C.

In his response to one of the questions in a Q&A session, the Fed Chair told attendees at the think tank that unbacked cryptocurrencies have not offered, or do not appear to offer, that payment use case that the public may really want to have.

According to him, cryptocurrencies are also not that great as a store of value, reiterating the fact that what crypto really is “is a speculative asset.”

Crypto and other risk assets eye fresh volatility

Powell’s remarks at the monetary policy conference come as crypto assets struggle with a crushing bear market that has Bitcoin trading below $20,000 and Ethereum looking to re-establish fresh momentum above $1,600. For Ethereum, it’s just days to what could be its most defining upgrade next week (around mid-September) – the Merge.

Ether was trading around $1,638 at the time of writing, nearly 4.5% up in the past 24 hours. ETH is also green over the week, but remains more than 7% down this past month following the dip from $2k

Meanwhile, the broader risk asset markets are bracing for tighter monetary policies from central banks.

On Thursday, the European Central Bank struck with a 75 basis point hike of its principal interest rate, while the Fed is set to set a third consecutive 0.75% hike at its next FOMC meeting on 20-21 September. Reaction across US equities saw some injection of volatility and helped major indices post a second day of modest gains.

The S&P 500 closed over 0.6% higher, as did the Dow Jones Industrial and Nasdaq, with the stock market poised for a weekly close that would help snap a three-week downturn.

Source link