‘Death Cross’ Could Indicate a Bearish Stock Market Is Near

Last week’s turbulent stock market has left investors on edge, with record-setting sell-offs erasing trillions of dollars in market value. President Donald Trump’s tariff announcements have only added to the uncertainty, pushing major indices like the S&P 500 and Nasdaq dangerously close to a “death cross” pattern. This ominous technical indicator, already visible in the Dow Jones Industrial Average and several other prominent stocks, is often a harbinger of bear markets.

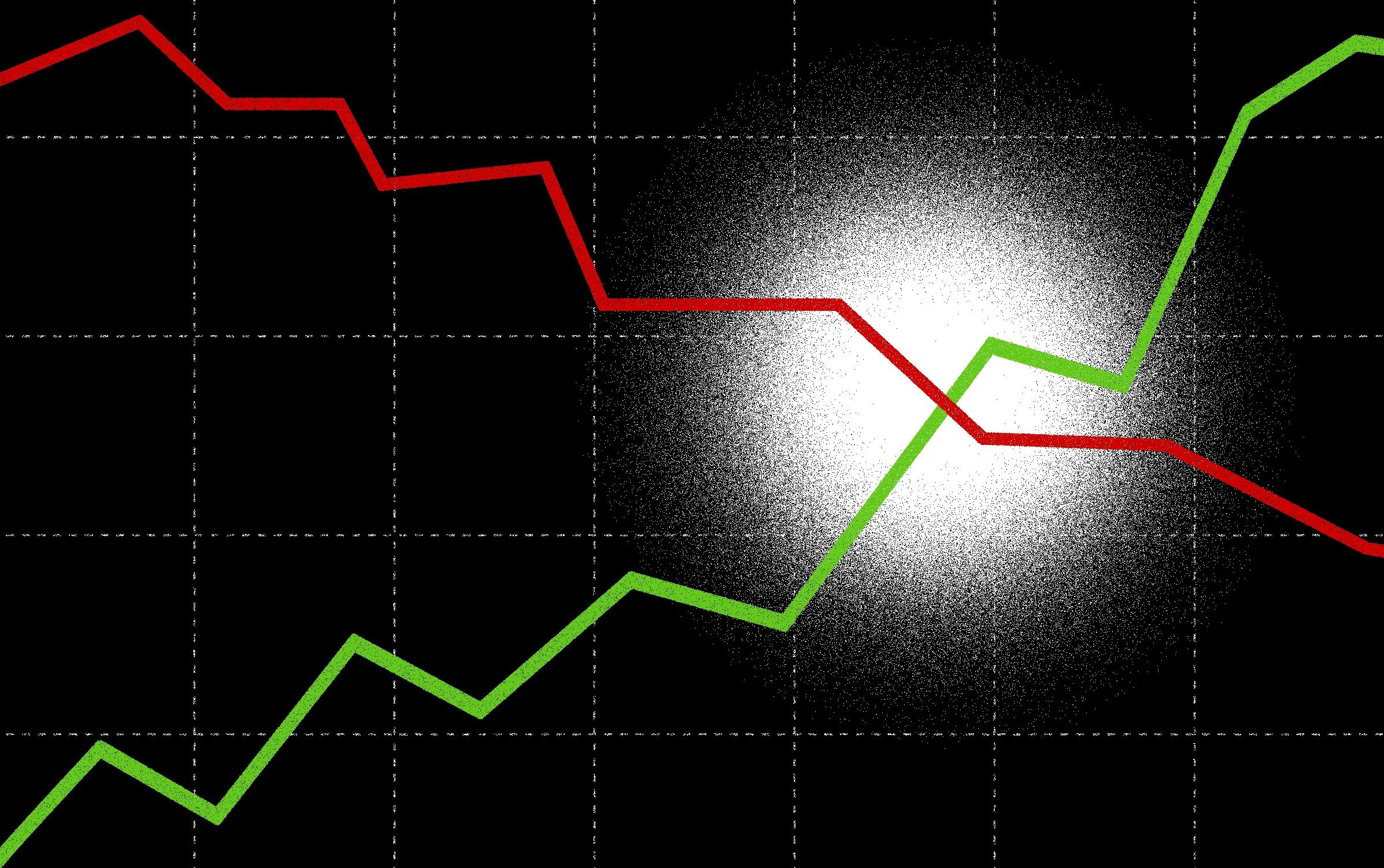

A death cross occurs when a short-term moving average crosses below a long-term moving average on a stock chart. In this case, the 50-day moving average (SMA) dipping below the 200-day SMA signals a shift from bullish to bearish momentum. While technical analysis is not foolproof, historical data shows that this pattern has preceded some of the most severe market downturns in history.

To understand the significance of a death cross, it’s essential to grasp the concept of simple moving averages (SMAs). These indicators track the average price of a security over a specific period, helping investors gauge trends in stock prices. The 50-day SMA reflects short-term movement, while the 200-day SMA indicates long-term trends. When the 50-day SMA crosses below the 200-day SMA, it suggests a weakening market sentiment and potential for extended losses.

The impending death cross in the Nasdaq serves as a stark reminder of the market’s vulnerability. As the 50-day SMA inches closer to the 200-day SMA, investors brace for further downside pressure. Historical data from financial services firm SoFi illustrates the predictive power of the death cross, signaling major downturns like the Wall Street crash of 1929 and the global financial crisis of 2008.

Currently, the S&P 500 and Nasdaq are teetering on the edge of a death cross, with the gap between their SMAs narrowing by the day. As investors navigate this uncertain terrain, it’s crucial to monitor these technical signals and stay informed about market trends. With the potential for a full-fledged bear market looming, prudent risk management and diversification are more critical than ever.

In conclusion, the recent market turmoil underscores the importance of staying vigilant and informed in today’s volatile environment. While the prospect of a death cross may raise alarm bells for investors, it also presents an opportunity to reassess portfolio strategies and prepare for potential challenges ahead. As we navigate these uncertain times, remaining adaptable and proactive will be key to weathering the storm and emerging stronger on the other side.