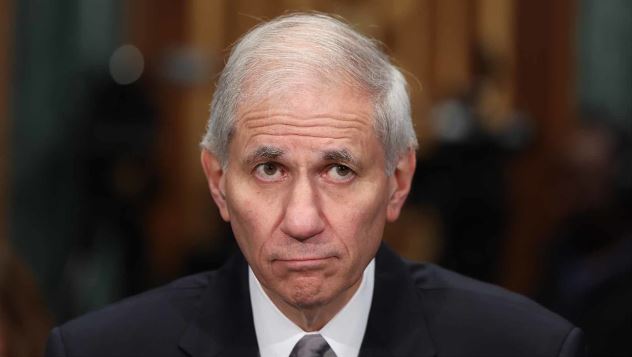

FDIC Head Resigns Following Damning Report on Agency Culture

The head of the Federal Deposit Insurance Corporation (FDIC) has announced their resignation in the wake of a scathing report highlighting a toxic culture within the agency. The report, which detailed numerous issues related to workplace environment and management practices, has sparked significant controversy and calls for reform.

The independent investigation revealed pervasive problems at the FDIC, including allegations of harassment, discrimination, and a general lack of accountability among senior officials. The findings have painted a troubling picture of the agency, which plays a critical role in maintaining public confidence in the U.S. financial system by insuring deposits and overseeing financial institutions.

In a statement, the outgoing FDIC head acknowledged the issues outlined in the report and expressed regret for not addressing them sooner. They emphasized the need for immediate and comprehensive changes to improve the agency’s work environment and restore its integrity. The resignation is seen by many as a necessary step towards beginning this process.

The report has prompted widespread criticism from lawmakers, financial industry stakeholders, and FDIC employees. Many have expressed disappointment and frustration over the agency’s failure to uphold a professional and respectful workplace. There are now growing calls for a thorough overhaul of the FDIC’s internal policies and management practices.

In response to the report, several lawmakers have announced plans to hold hearings to further investigate the issues within the FDIC and explore potential legislative solutions. These hearings aim to ensure that the agency is held accountable and that measures are put in place to prevent similar problems in the future.

The resignation of the FDIC head marks a significant moment for the agency. It underscores the importance of leadership in fostering a positive and ethical workplace culture. As the FDIC navigates this period of transition, there will be intense scrutiny on the steps it takes to address the findings of the report and implement meaningful reforms.

The search for a new FDIC head will likely focus on finding a leader with a strong commitment to transparency, accountability, and employee welfare. This individual will be tasked with guiding the agency through a challenging period and rebuilding trust among its employees and the public.

The fallout from the report serves as a reminder of the critical importance of maintaining high standards of conduct and integrity within federal agencies. The changes that follow will be closely watched as a measure of the FDIC’s commitment to rectifying the issues and ensuring a healthier workplace culture moving forward.