Federal Reserve holds interest rates steady, but trims economic growth outlook

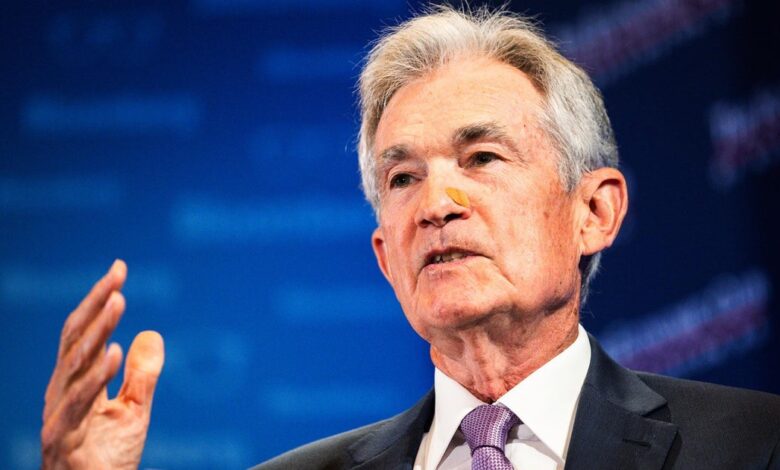

The Federal Reserve made the decision to keep its benchmark interest rate steady on Wednesday, as Chair Jerome Powell expressed concerns about the uncertainty surrounding the potential impact of the Trump administration’s trade and economic policies.

The Fed’s announcement highlighted the increased uncertainty in the economic outlook, stating that they would be prepared to adjust monetary policy if necessary to address any risks that could hinder the achievement of the committee’s goals. Economic projections released on Wednesday indicated a slower growth rate for the economy this year, with projected unemployment rates rising to 4.4% from 4.1% in February. Inflation is expected to edge up to 2.7% from its current level of 2.5%.

Projections for the nation’s gross domestic product (GDP) were revised down, with expectations of a 1.7% expansion this year compared to the previous forecast of 2.1% in December. Powell noted that inflation has started to increase, partly in response to tariffs, and there may be a delay in further progress throughout the year.

Although Powell suggested that any inflation resulting from tariffs would likely be temporary, he acknowledged the difficulty in distinguishing between price increases caused by tariffs versus other factors. Economists have warned that the Trump administration’s trade policies, including upcoming tariffs on Canada and Mexico, could lead to higher inflation and impact economic activity.

Despite concerns about the potential impact of trade policies on economic growth, the Fed maintained the federal funds rate at 4.25% to 4.5%. The central bank’s dot plot indicated a median projection for the federal funds rate at 3.88% by the end of 2025, suggesting potential rate cuts of 50 basis points this year.

Most economists anticipate that the Fed will lower interest rates two or three times in response to inflation moving closer to the 2% target. Following the FOMC decision, stock markets saw modest gains, with benchmark indexes increasing by about 1% or more.

The decision to keep interest rates steady reflects the Fed’s cautious approach in the face of economic uncertainty, particularly related to trade policies. The impact of tariffs and other economic factors will continue to be closely monitored as policymakers assess the need for further adjustments to monetary policy.