How Much Are Tariffs on Chinese Goods? It’s Trickier Than You Think.

The escalating trade war between the United States and China has created deep uncertainty for U.S. companies that rely on Chinese suppliers. Retaliations in recent days by the two countries have resulted in huge average tax rates on their each other’s imports, with tariffs often costing more than the price of the goods themselves.

But because of an ever-changing patchwork of trade rules, not every product will be charged an astronomical tariff, trade lawyers, customs brokers and importers say. In some cases, tariffs will pile on other tariffs. In other instances, they can reduce costs, while other times they can cancel out new ones.

The new 125 percent rate that President Trump imposed will in many cases be added on top of long-existing duties. There are four main categories of tariffs that are imposed on goods from China.

A standard tax applied to imports from the world. The rate depends on the goods. Most rates are very low.

Taxes introduced during the first Trump administration and expanded by former President Joseph R. Biden as a way to protect U.S. industries.

Trump imposed a 25% tariff on these imports worldwide.

-

+25%

On steel and some products that contain steel.

-

+25%

On aluminum and some products that contain aluminum.

-

+25%

On cars and car parts.

Trump imposed and raised tariffs on Chinese goods multiple times this year.

-

+20%

On all goods as a punishment for the flow of fentanyl into the United States.

-

+125%

On all goods in an effort to reset the trade balance between the two countries.

Rates ultimately depend on what is imported, what materials are used (from where), which special rates are applied and what sorts of products are exempt.

Understanding which tariffs will apply and which ones won’t will ultimately determine what businesses choose to buy, how they’ll factor in the new costs — if they can even afford them — and what they may ultimately pass on to their customers.

“Companies are scrambling to mitigate their tariff exposure, particularly those with supply chains involving China,” said Richard A. Mojica, a customs lawyer at Miller & Chevalier. “But there are only a few levers they can pull.”

Here is how the import duties on certain goods from China add up:

-

0%

Base tariff

-

100%

Pre-2025 extra tariff

-

20%

Fentanyl” tariff

-

125%

Reciprocal” tariff

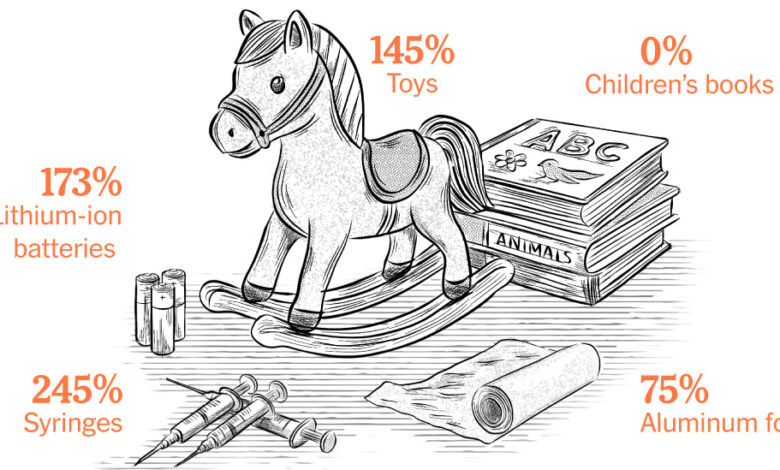

Syringes and needles are charged some of the highest tariff rates. These items are among the Chinese goods targeted initially by the first Trump administration and then subject to increases under Mr. Biden. His administration levied a 100 percent tariff on syringes and needles last September as a part of an effort to protect American factories and show a tough-on-China stance.

These types of tariffs on Chinese goods can range from 7.5 percent up to 100 percent and apply to clothing, solar panels, electric vehicles and other goods that China has been accused of selling at far lower prices than many American businesses do.

With this week’s tariffs included, American importers will now have to pay a 245 percent tariff — or roughly 2½ times the cost of the product itself.

-

0%

Base tariff

-

20%

Fentanyl” tariff

-

125%

Reciprocal” tariff

Over three-quarters of toys imported into the United States come from China, making it America’s biggest supplier. Previously, things like tricycles, stuffed animals, dolls and puzzles could enter the country duty free. Now, all these items are charged a 145 percent import tax.

The anticipated increase in retail prices for various items is expected to be substantial.

For example, wool sweaters are subject to a 16% base tariff, as well as additional tariffs introduced during the previous administration. With recent tariffs aimed at addressing the flow of fentanyl from China, the import tax on wool sweaters has risen significantly.

Similarly, outdoor chairs face a 0% base tariff, but are subject to a 25% pre-2025 extra tariff and a 25% aluminum and steel tariff. These tariffs, along with the recent reciprocal tariffs, have impacted the prices of these items.

In the case of door hinges, a 2% base tariff is applied, along with a 7.5% pre-2025 extra tariff and a 12.5% aluminum and steel tariff. Additionally, a 25% tariff on cars and car parts further affects the cost of these products.

On the other hand, children’s books, which make up a significant portion of imports from China, remain duty-free. This exemption is part of the few classes of goods not affected by the new tariffs on China.

If your business relies on Chinese suppliers, we want to hear from you. Share how the tariffs are impacting your operations, and we will review each response carefully. Your input is valuable to us, and we will handle your information confidentially. sentence in a different way:

“The dog eagerly chased after the ball.”

The ball was eagerly chased after by the dog. following sentence:

I went to the store to buy some milk and bread.

I went to the store to purchase milk and bread.