I.R.S. Audits Are at a Record Low. Trump’s Cuts Could Make Them Even Rarer.

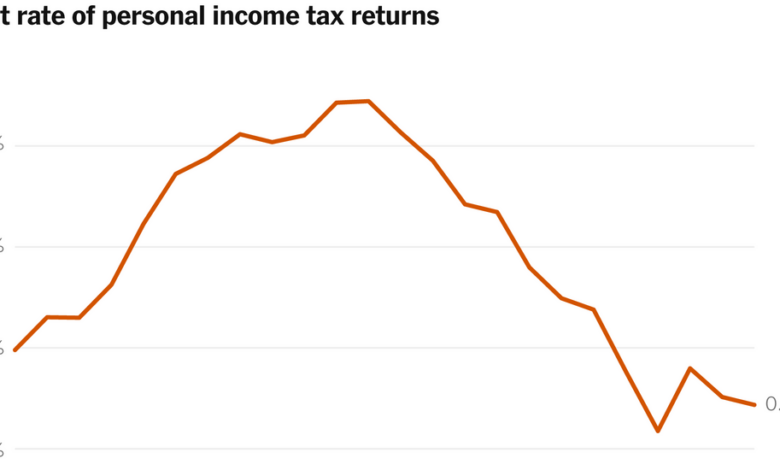

The audit rate at the Internal Revenue Service has reached historic lows in recent years, according to a New York Times analysis. If the Trump administration moves forward with its plan to reduce the agency’s workforce, audits are expected to become even more infrequent.

Recent data from the IRS shows that the audit rate for individual taxpayers has decreased significantly since 2010. In fact, the effective audit rates between 2020 and 2023 were lower than any published rates since at least 1950.

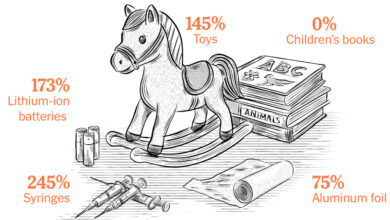

In the 2010s, audit rates dropped across all income levels, making an audit a rare occurrence for most Americans by the end of the decade. The decrease in audits has resulted in less revenue for the government, with the agency collecting significantly less from personal income audits in recent years compared to 2010.

The Trump administration is aiming to cut the IRS workforce by approximately 25%, a move that is expected to further reduce audit rates. The decrease in audits over the past decade has largely been attributed to the loss of IRS employees, with the agency cutting its headcount by about 20% from 2010 to 2020.

While the Biden administration attempted to reverse this trend by adding more employees to the IRS, funding for enforcement efforts has faced challenges. The potential cuts in IRS staffing levels could result in a significant loss of revenue over the next decade.

Despite arguments from Republicans that audits are a form of harassment, the Biden administration aimed to increase audit rates for high-income earners, partnerships, and corporations. In-person audits of high-income individuals have the potential to generate substantial additional tax revenue.

Audits also have long-term financial benefits for the government, deterring taxpayers from violating tax laws in the future. Research has shown that audited taxpayers tend to pay more in taxes in subsequent years, highlighting the importance of enforcement efforts.

Overall, the reduction in audit rates and IRS staffing levels could have significant implications for government revenue and tax compliance in the years to come.

This content has been reformatted for a WordPress platform and retains the key points from the original article while presenting them in a unique manner.