Meet the Monster Stock That Continues to Crush the Market

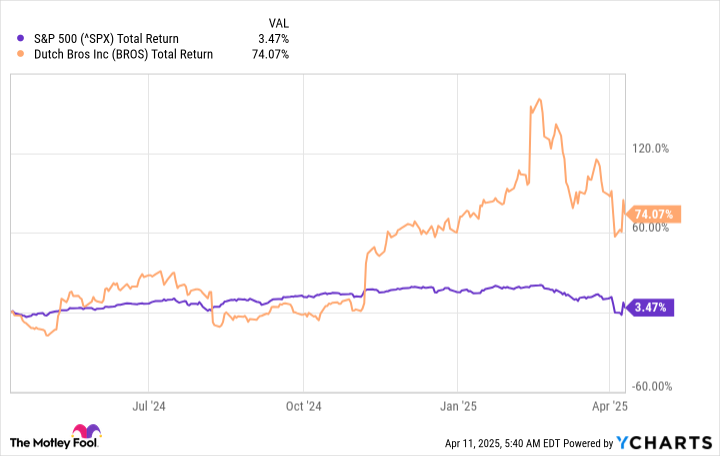

The stock market has been experiencing a rollercoaster ride lately, with companies and investors closely monitoring President Trump’s tariff directives. The uncertainty surrounding tariffs has created a sense of excitement, albeit a nerve-wracking one. Amidst this volatility, Dutch Bros (NYSE: BROS) has emerged as a standout performer, defying the odds and outpacing the S&P 500 index by a significant margin.

Dutch Bros, a relatively young and riskier stock, has seen its value surge by 9% this year, while the broader market has witnessed a 10% decline. The company’s stellar performance can be attributed to its strategic positioning and unique value proposition in the market. Unlike its larger counterpart, Starbucks, which has been grappling with challenges due to its sheer size and complexity, Dutch Bros has capitalized on the opportunity to carve out its niche and build a loyal customer base.

Founded in Oregon, Dutch Bros has rapidly expanded its footprint, surpassing 1,000 stores primarily on the West Coast, with a strong presence in California. The company’s success can be attributed to its emphasis on quick and friendly service, innovative menu offerings, and customer-centric approach. In the 2024 fourth quarter, Dutch Bros reported a 35% year-over-year revenue increase, driven by new store openings and strong same-store sales growth.

Looking ahead, Dutch Bros remains optimistic about its growth prospects, with plans to ramp up its store count to at least 7,000 in the long term. The company’s recent initiatives, such as launching mobile ordering and enhancing its membership program, are expected to be key drivers of future growth. Despite its premium valuation, investors are bullish on Dutch Bros’ potential to capture a larger market share and deliver robust returns in the future.

While Dutch Bros may not be considered a bargain investment in the current market conditions, its growth trajectory and strategic initiatives signal a promising outlook. For investors with a long-term horizon and a tolerance for risk, Dutch Bros could prove to be a lucrative addition to their portfolio. It’s essential to conduct thorough research and consider the company’s growth prospects before making any investment decisions.

In conclusion, Dutch Bros’ success story underscores the importance of agility, innovation, and customer focus in navigating the volatile market landscape. By staying true to its core values and leveraging emerging trends, Dutch Bros has positioned itself as a formidable player in the competitive coffee industry. Investors keen on tapping into the company’s growth potential should carefully evaluate the risks and rewards associated with investing in Dutch Bros.