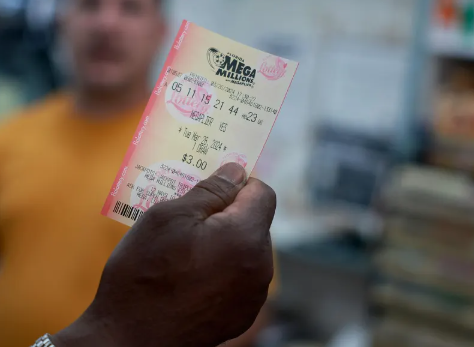

The Mega Millions jackpot has climbed to a staggering $579 million, making it one of the most talked-about lottery prizes this year. While the prospect of winning such a fortune is exciting, the actual take-home amount after taxes will significantly reduce the jackpot’s headline figure.

If a single winner chooses the lump sum option, they will receive approximately $281.1 million before taxes. Federal taxes will claim 24% upfront, totaling about $67.5 million. Depending on the winner’s state of residence, additional state taxes could further reduce the amount. For example, in states like New York, the tax rate can be as high as 10.9%, while tax-free states like Florida or Texas would allow the winner to keep more of their earnings.

After accounting for federal taxes alone, the winner would take home roughly $213.6 million. State taxes could cut this amount further, potentially leaving the winner with around $190–$210 million, depending on their location. Winners who opt for the annuity payment will receive the full $579 million over 30 years but will still face annual tax deductions.

Financial advisors recommend that lottery winners consult with experts to manage their windfall responsibly. Common advice includes paying off debts, investing wisely, and setting up trusts to protect and grow their newfound wealth.

The next Mega Millions drawing will take place on Friday, offering ticket holders another shot at changing their lives forever.