More Americans buy groceries with buy now, pay later loans

The use of buy now, pay later loans for purchasing groceries is on the rise in America, according to new data released by Lending Tree. This trend indicates that some consumers are facing financial challenges in the current uncertain economy, with inflation, high interest rates, and tariff concerns adding to the pressure.

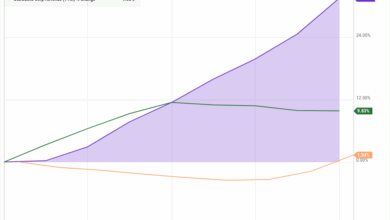

A survey conducted by Lending Tree revealed that around half of the 2,000 U.S. consumers aged 18 to 79 had used buy now, pay later services. Of those consumers, 25% reported using these loans to buy groceries, a significant increase from previous years. Additionally, 41% of respondents admitted to making late payments on their buy now, pay later loans in the past year.

Matt Schulz, Lending Tree’s chief consumer finance analyst, noted that many people are struggling to make ends meet and are looking for ways to stretch their budgets. While buy now, pay later loans can offer a convenient way to manage expenses, consumers should be cautious as late payments can result in high fees and potential financial troubles, especially if multiple loans are taken out simultaneously.

Schulz stopped short of labeling the data as a recession indicator but expressed concerns about the ongoing economic challenges. He emphasized the importance of responsible financial management when using buy now, pay later loans to avoid falling into a debt trap.

The popularity of buy now, pay later loans extends beyond groceries, with reports indicating that consumers are using this financing option for various purchases, including concert tickets and food deliveries. The reliance on debt to maintain lifestyle choices has sparked debates about consumer behavior and the state of the economy.

Despite previous resilience, recent warnings from major companies like Walmart and Delta Airlines about weakening demand suggest that consumers may be feeling the effects of economic pressures. As uncertainties persist, it is crucial for individuals to be mindful of their financial decisions and seek ways to navigate challenging times responsibly.