Tariffs are driving investors to Pokémon and Mickey Mantle — these aren’t your grandfather’s trading cards

Trading Cards: The New Frontier of Investment

For years, Wall Street has defined what qualifies as a legitimate investment – stocks, real estate, and more. However, the perception of trading cards as mere hobbyist items is rapidly changing. As tariffs drive up import costs, investors are turning to domestic assets like collectibles and trading cards for alternative investment opportunities.

The global collectibles industry, valued at over $600 billion, includes trading cards worth more than $15 billion as of 2024. Trading cards are no longer just nostalgic items but recognized as financial instruments with long-term value.

Trading cards share key characteristics with traditional investments – they are limited-edition, authenticated assets with dedicated collector bases. Unlike digital assets, trading cards have weathered economic uncertainties, proving their resilience over time.

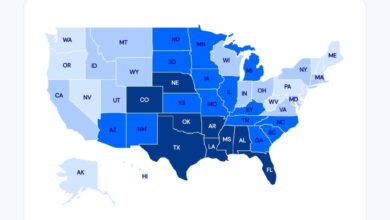

Market data shows a significant growth in graded trading card transactions, indicating a steady rise in interest over the years. Notably, the sub-$1,000 category has seen substantial growth, making trading cards accessible and appealing to a wide range of collectors and investors.

The surge in Pokemon card values exemplifies the growing recognition of trading cards as viable alternative assets in today’s market. Investors are increasingly turning to trading cards for their liquidity and diverse price points.

As traditional goods become pricier and less accessible, trading cards offer a stable investment option. With a rich market history, strong infrastructure, and proven durability, trading cards present an attractive opportunity for those looking beyond conventional markets.

Investing in trading cards is not a new trend but a timeless opportunity viewed with fresh perspective. With the market evolving rapidly, trading cards are poised to become a mainstream investment choice for savvy investors.

Leore Avidar is the founder and CEO of Alt, a platform reinventing alternative asset transactions. Alexis Ohanian, founder of Reddit and investor in Alt, is pioneering new investment frontiers through his ventures.