Tariffs spell trouble for VCs amid Klarna, StubHub IPO delays

The venture capital industry is facing a tough outlook in the midst of ongoing uncertainty caused by U.S. tariffs. Last week’s stock market rout, combined with a lack of initial public offerings and mergers and acquisitions, has put significant strain on VC funds. With startups choosing to stay private for longer, venture capitalists are finding it difficult to realize gains on their investments.

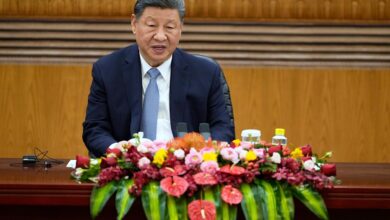

Following President Donald Trump’s announcement of reciprocal tariffs, major tech unicorns like Klarna and StubHub have delayed their plans to go public due to the sharp decline in global equity markets. This turbulence has made it challenging for startups to raise capital, whether from the stock market or venture capital, as valuations may decrease.

Private markets do not fluctuate in the same way as public markets, making it harder for tech startups to raise capital in the current climate. Antler’s Tobias Bengtsdahl noted that valuations of venture-backed startups typically only change when they are raising a new equity round. This situation has a significant impact on funds and startups seeking investment from multi-stage investors.

The uncertainty surrounding tariffs may provide an opportunity for Europe’s private tech startups to shine. Sanjot Malhi of Northzone believes that Europe could benefit from the flow of talent and liquidity if the U.S. market becomes less favorable. Christel Piron of PSV Foundry sees a silver lining in how European founders are choosing to stay and scale their businesses in the region, contributing to the development of a resilient European tech ecosystem.

Despite the challenges, there are alternative exit routes for venture capital funds, such as mergers and acquisitions. Malhi predicts a strong M&A landscape in the longer term, with stakeholders seeking problem-solving exits. However, there is a risk of late-stage firms facing down rounds, where they raise funds at reduced valuations.

Investors are hopeful for a resurgence of big tech IPOs later in Trump’s presidency, as many had anticipated a revitalized IPO market under his administration. While the market may tolerate delays in meeting these expectations, there is optimism for a return to a more favorable environment for venture capital investments. There is a growing demand from the public for certain actions to be taken within a specific timeframe, particularly within a political leader’s term. This sense of urgency is fueled by various factors, including the need for change, accountability, and progress.

When people demand that certain actions be carried out within a leader’s term, they are essentially expressing their expectations and holding the leader accountable for delivering on their promises. This can apply to a wide range of issues, from economic reforms to social justice initiatives.

In the context of politics, the demand for action within a leader’s term is often driven by the desire for tangible results and meaningful impact. Citizens want to see positive changes in their communities and countries, and they expect their leaders to fulfill their responsibilities in a timely manner.

However, meeting these demands within a specific timeframe can be challenging, especially when faced with complex issues and obstacles. Leaders must navigate through political hurdles, bureaucratic processes, and public opinion to make meaningful progress on their agenda.

Ultimately, the demand for action within a leader’s term reflects a sense of urgency and accountability in the eyes of the public. It serves as a reminder to those in power that they have a responsibility to fulfill their promises and work towards the betterment of society.

In conclusion, the demand for certain actions to be taken within a leader’s term is a reflection of the public’s expectations and desire for progress. It underscores the importance of accountability and the need for leaders to deliver on their commitments in a timely manner.