What Is a Tax Deduction and How Does It Work?

Ever seen a post on social media asking you to make a tax-deductible contribution to a charity? (Hopefully it was a legit one and not George Costanza’s Human Fund.) Or maybe you had a conversation with your dad about tax write-offs for mortgage interest and your eyes glazed over. We’ve been there too! (Sorry, Dad).

Donations to charity and interest expenses are two types of tax deductions. And deductions are a good thing because they lower your taxes. They’ll help you shave hundreds, maybe even thousands of dollars off your tax bill.

Simply put, a tax deduction is an expense or expenditure that can be subtracted from your income to reduce how much you pay in taxes.

A lot of folks don’t know which tax deductions are available or how to claim them on their tax returns. But you don’t want to be that guy or gal, because it could mean you’re leaving a good chunk of money in the hands of the IRS without even knowing it!

What Is a Tax Deduction?

When you hear the word deduction, just think subtraction. You’re simply subtracting how much of your income is taxed and reducing how much you owe to Uncle Sam in the process. Cha-ching!

Taxes shouldn’t be this complicated. Connect with a RamseyTrusted tax advisor.

For example, charitable donations are one of the most common tax deductions. That means you could “write off” the money you gave to charity last year and reduce your taxable income by the amount you gave.

So, if your income is $50,000 and you gave a $1,000 gift to your favorite charity last year, you could claim that gift as a tax deduction, and you’ll only be taxed on $49,400 instead of $50,000.

But that’s only scratching the surface! From retirement plan contributions to home mortgage interest, there are dozens of tax deductions you might be able to take advantage of. Maximize your deductions to minimize your taxes.

What’s the Difference Between a Tax Deduction and a Tax Credit?

While tax deductions lower your taxable income, tax credits cut your taxes dollar for dollar. So, a $1,000 tax credit cuts your final tax bill by exactly $1,000. A tax deduction isn’t as simple. If you get a $1,000 tax deduction and you’re in the 22% tax bracket, that deduction reduces your taxable income and saves you $220 when it’s all said and done.

Tax credits fall into two main categories: refundable and nonrefundable. If you have a refundable tax credit of $500 but only owe $200 in taxes, the IRS will send you a check for $300. On the other hand, if you have a nonrefundable tax credit worth $750 but you only owe $250 in taxes, you unfortunately won’t get a check for $500 (the balance of the credit you didn’t use).

How Do Tax Deductions Work?

When you’re filling out your tax return, there are two ways to claim tax deductions: Take the standard deduction or itemize your deductions. You have to pick one!

The standard deduction is an amount set by the IRS each year, and it is the easy option—it’s like an automatic tax freebie. If you choose to take the standard deduction, your taxable income is automatically reduced by a set amount based on how you file (like single, married filing jointly, or married filing separately). That lowers the amount of taxes you have to pay. No need to dig through receipts or bank statements to find your deductions.

Itemizing your deductions takes more work—you’ll need to list all the deductions you want to claim one by one. And you’ll have to fill out a Schedule A form with your tax return and save your records to back up your claims.1

Yes, itemizing is a bit of a hassle, but it’s worth the effort if you can claim enough deductions to lower your taxable income more than the standard deduction.

How do you know which option is best for you? There are a few things you need to know before you make your decision this year.

What Is the Standard Deduction for the 2022 and 2023 Tax Years?

Thanks to the 2018 tax reform bill, the standard deduction almost doubled from what it used to be. That’s great news for many taxpayers! For the 2022 tax year, the standard deduction has been adjusted slightly for inflation. So, if you’re single, the standard deduction is now $12,950. Married and filing together? Your standard deduction is $25,900. Those numbers continue to climb in 2023.2

| Filing Status | 2021 | 2022 | 2023 |

| Single | $12,550 | $12,950 | $13,850 |

| Married Filing Jointly | $25,100 | $25,900 | $27,700 |

| Married Filing Separately | $12,550 | $12,950 | $13,850 |

| Head of Household | $18,800 | $19,400 | $20,800 |

Important to note: If you or your spouse are over 65 or legally blind, you might be able to get a larger standard deduction. But if you’re a nonresident alien or a dual-status alien, or someone else claims you as a dependent on their return, your standard deduction may be lower. Be sure and check with a tax pro if you have any questions.3

What Expenses Are Tax Deductible?

First, let’s take a look at what you can write off from your taxes. Here are some of the most common deductions that many taxpayers can take advantage of:

Charitable Donations

The more you give, the more you can deduct from your taxes! If you itemize your deductions, any money you gave to your church, your alma mater, or your favorite charities can all be written off your taxes. You can deduct any amount of charitable giving up to 60% of your taxable income.4 Nice!

But even if you don’t itemize your deductions, Congress passed a spending package last year that allows you to take an “above-the-line” deduction (which lowers how much of your income is taxable) of charitable gifts up to $300 for individuals and up to $600 for married filing jointly.5

Medical Expenses

Do you have health insurance but still find yourself paying out of pocket for medical or dental expenses? The IRS lets you deduct medical expenses that are more than 7.5% of your taxable income for things like appointments with medical professionals or dentists, prescription drugs, contacts or eyeglasses, and health insurance premiums (paid for with after-tax dollars and not reimbursed by your employer), just to name a few!6

To break it down: If your adjusted gross income is $50,000, then 7.5% of that is $3,750. So, if you have $5,000 of medical expenses that weren’t covered by your health insurance, subtract the $3,750 from that and you get $1,250 as a tax deduction.

State and Local Taxes

A lot of folks forget this one! The IRS lets you choose to deduct either your state and local sales tax or income tax, along with some foreign taxes. If you live in a state with no income tax or you made some big purchases like a new car or a furniture set for the living room, the sales tax deduction is the way to go. To calculate your deduction, check out the IRS sales tax deduction calculator. And if you’re a homeowner, you can also deduct property taxes from your tax bill.

The 2018 tax law caps the total amount you can deduct in income, sales and property taxes to $10,000.7,8

Student Loan Interest

If you’ve been paying so much in student loan debt that Sallie Mae seems like that smelly college roommate who just wouldn’t go away, take some comfort in the fact that you can claim a student loan interest deduction of up to $2,500.9 This deduction is an adjustment to income, meaning you don’t have to itemize to take it. It also gradually phases out as your income increases.10

Mortgage Interest

Ah, the joys of homeownership! There’s the big backyard, the white picket fence, your mortgage payments . . . okay, maybe not that last part. But at least you can deduct the interest you paid on up to $750,000 of mortgage debt.11

Retirement and Investing

If you happen to have a traditional IRA, those contributions are most likely tax-deductible. But your deduction might be limited based on your income and whether or not you (or your spouse if you’re married) have a retirement plan through your workplace.12

But here’s the catch: You’ll have to pay taxes on the money you take out of your traditional IRA in retirement. Yuck. That’s why we recommend investing with a Roth IRA instead. Roth IRAs are funded with taxed income. You won’t be able to deduct Roth contributions off your taxes now, but who cares? You’ll be too busy enjoying tax-free growth and withdrawals in retirement later. Future you will thank you!

Home Office Deduction

If you’ve turned part of your home into your own workspace used only for business, you can write off work-related expenses like rent, utilities and maintenance costs.13

Itemizing vs. the Standard Deduction: Which Should I Choose?

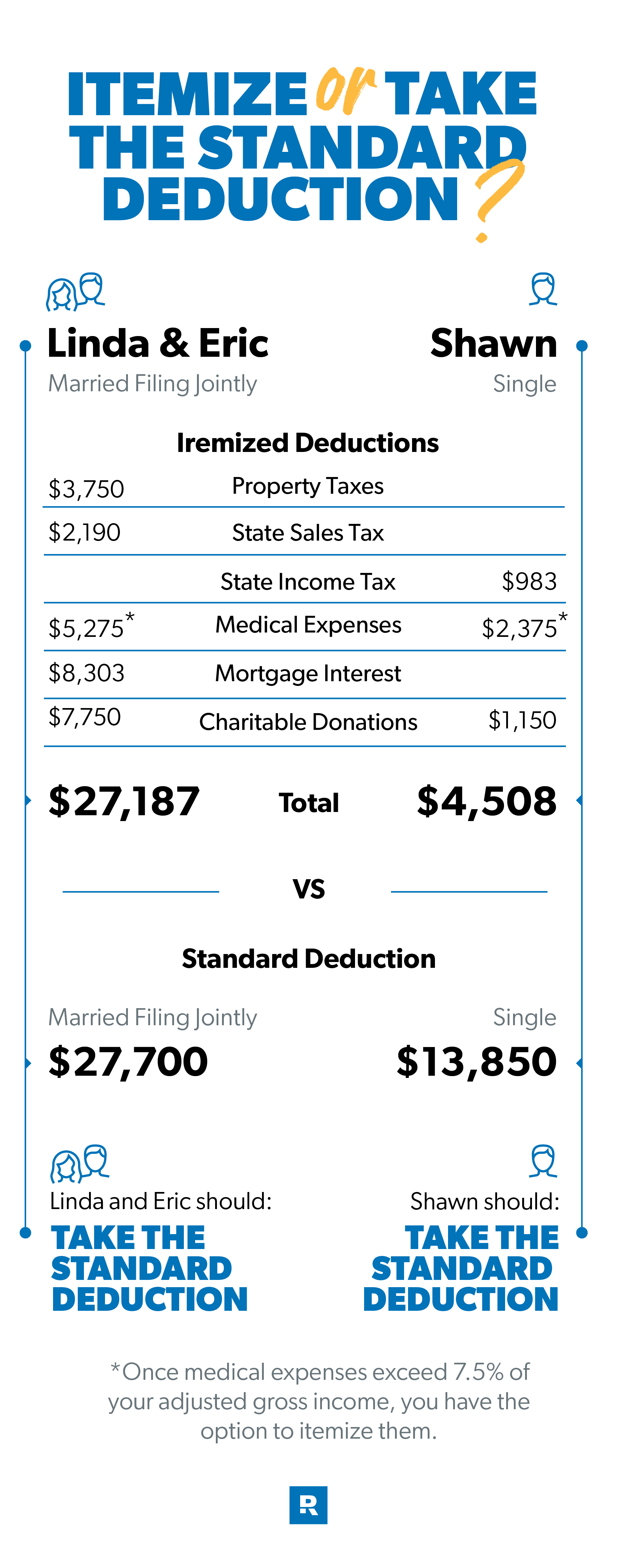

Here’s the deal: With the big increase in the standard deduction, taking that automatic deduction will make sense for more taxpayers than before. But it’s still important to add up your itemized deductions before you make that decision.

Take Linda and Eric, for example. They’re married and filing jointly, so they automatically qualify for that $25,900 standard deduction—and they’re excited about that huge amount!

But just to be sure, they go through their records to find all the tax deductions they can claim if they choose to itemize. Would they save money that way?

After adding up their itemized deductions, they see they can knock more than $27,000 off their taxable income, potentially saving them hundreds of dollars in taxes.

Do you think Linda and Eric regret going back through all their receipts, files and bank statements? Not a chance!

Still, for many other taxpayers, the new standard deduction is far and away the better option.

Meet Shawn. He’s a single guy just starting out in his career. He’s putting in crazy hours at his accounting job and renting a small apartment while he tries to work through his debt snowball. Since he doesn’t have that many expenses to deduct, the standard deduction offers a much larger tax break than itemizing would. That’s a no-brainer!

When it comes to taxes, everyone’s situation is different. There is no one-size-fits-all solution! If you’re a homeowner or business owner, you made a lot of charitable contributions, or you paid out of pocket for hefty medical expenses, then itemizing might be the best move for you.

But if you’re planning to take the standard deduction or decide to self-file, Ramsey SmartTax makes it easy and affordable to do your taxes—with no hidden fees. That’s what we call a win-win!

Maximize Your Refund With an Expert Tax Consultant

The bottom line? You want to be sure you’re getting the most out of all these tax deductions. Just one missed deduction could cost you far more than the fee of a tax professional.

That’s why when you’re in doubt, you should turn to a tax advisor. With years of experience behind them, their wealth of knowledge can take the guesswork out of taxes—protecting you and your wallet.

The sooner you connect with a pro, the sooner you can check taxes off your to-do list. Find a tax expert today!

If you’re confident you can handle your own taxes and just want easy-to-use tax software, check out Ramsey SmartTax—we make filing your taxes easy and affordable.

Source link